Get the Most Value from Your Old Vehicle

Should I trade, sell, or donate my old car? It's the dilemma people face when they upgrade their vehicles. If you're looking for the "Best place to donate my car Minneapolis," donate to a non-profit like Newgate School to get value for your unwanted vehicle.

Make Room for Your New Ride

You found a new Ford Bronco for sale, and you can't wait to put one in your garage. Except your old car is taking up a space, making the driveway a bit crowded. Despite the demand for used cars, you were disappointed with the dealer's offer for your old 4-door hatchback. So that leaves you with the option of selling or donating your vehicle.

Does Your Donation Help Your Community?

When you search Google for "Best place to donate my car Minneapolis," you'll see a lot of paid ads for organizations benefitting veterans and children. Who doesn't want to help vets and kids, right? But look closer, and you'll find that those are all large national organizations. There's no guarantee your old sedan will be used to benefit your local community.

A Non-Profit that Benefits People in Your Community

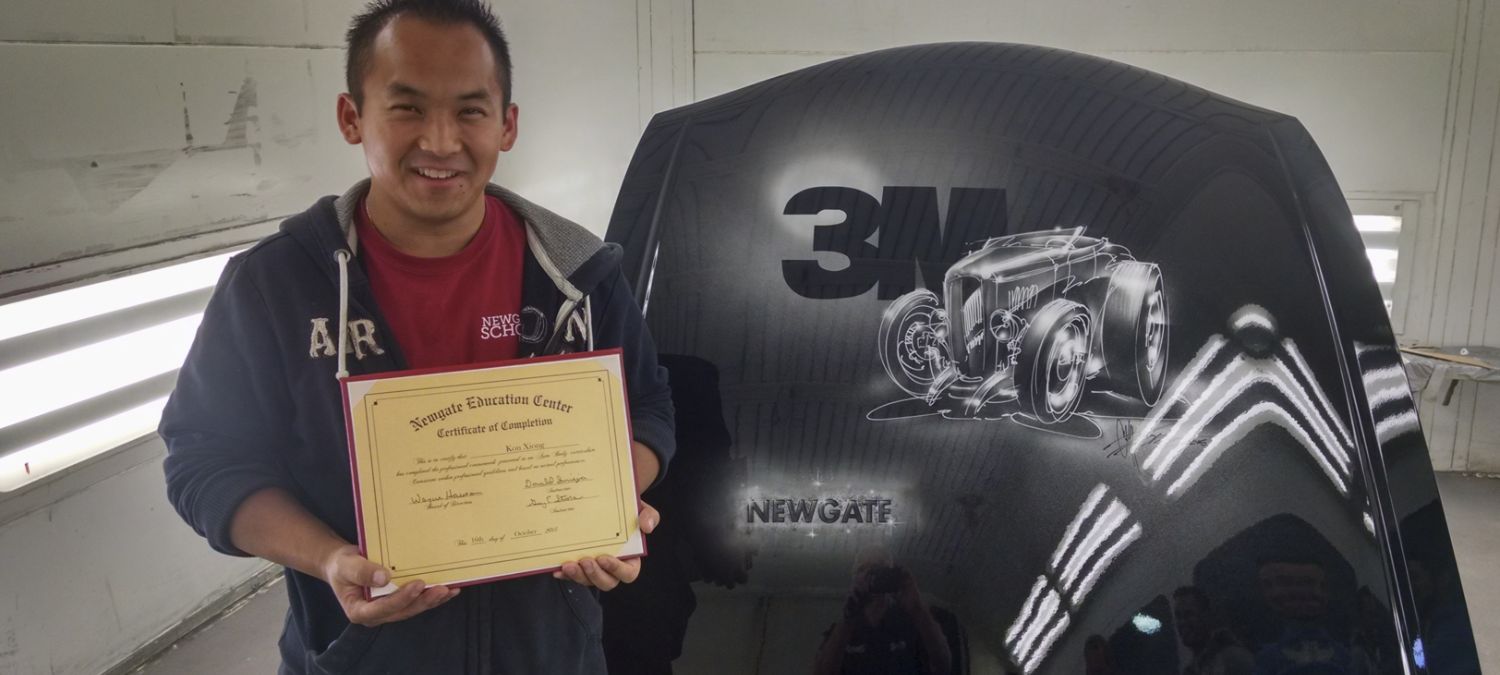

If you want to be sure your car donation will help people in your community, look for a local non-profit that will use the funds from your vehicle to support people in and around Minneapolis. One such organization directly benefiting people around the Twin Cities is Newgate School.

What Makes Newgate Different from Other Local Non-Profits

Newgate School provides no-cost vocational training in auto body repair and automobile mechanics. So, while other non-profit organizations outsource the repair and reconditioning of donated vehicles, Newgate uses your car donation in their training programs.

That helps disadvantaged people in the area train for stable, well-paying careers in the automotive industry, helping them escape low-wage, dead-end jobs. Becoming contributing members of the community takes the pressure off social service agencies and other organizations.

And for a family on a restricted budget, finding an affordable used Ford Explorer for sale may be the answer to their prayers.

How Big of a Tax Deduction Can You Expect?

Naturally, you want your donation to help people, but you also want the maximum tax deduction possible. Newgate maximizes your deduction in one of two ways. If the car sells, your deduction is the amount it sells for.

If your car is donated to a local single working mother in our Wheels for Women program, your deduction will be the highest amount allowed by the Internal Revenue Service.

Your Search for "Best Place to Donate My Car Minneapolis" Is Over!

Still wondering, "Where is the best place to donate my car?" How about the place where you can see the difference your donation makes?

With many non-profits, you can't see where your donation goes. But when you donate your vehicle to Newgate School, your vehicle not only helps people learn a valuable trade, but the proceeds from its resale help the school continue providing free education to disadvantaged people in the community.

And what a great feeling it is to see your old all-wheel-drive SUV or truck back on the road again, knowing it keeps helping people.

Donate Your Car to Newgate School Today

Are you ready to make a difference? Donate your car to Newgate School in Minneapolis, MN, and make a difference in your community. Your vehicle donation is tax-deductible, and 100% of the profits go to our school for tuition-free training for underserved young adults in our area. We even give away free refurbished cars to single mothers in our region through our Wheels for Women Program.

We can accept almost any used car, truck, SUV, or motorcycle, whether operable or not. We will pick up and tow your used vehicle. Donate your car to Newgate School today!